Introduction

India’s crypto journey has been nothing short of dramatic. From banning banks from dealing with crypto firms in 2018 to seeing the Supreme Court overturn that decision in 2020, the country’s stance has swung like a pendulum. In the absence of clear regulations, crypto investors have suffered from improper trading, been taxed heavily, yet have lacked legal clarity and consumer protections.

Now, with June 2025 set as the month for India’s first formal crypto rules, all eyes are on New Delhi. The decisions made this month could redefine not just how crypto works in India but whether it grows or fades away.

Below is a reaction from, Crypto Industry from India official-style post for X on the topic of India releasing its crypto rules in June 2025

Official Crypto Rules By Finance Ministry, the Reserve Bank of India (RBI)

The Indian government is expected to release official crypto rules by June 2025. For the first time, key bodies such as the Finance Ministry, the Reserve Bank of India (RBI), and the Securities and Exchange Board of India (SEBI) are collaborating to shape the future of digital assets in the country.

These upcoming rules are expected to cover how crypto is classified, how exchanges are licensed, how taxes are handled, and how users are protected. It matters because it will bring much-needed clarity to the market for investors, businesses, and regulators alike. Buying and selling cryptocurrencies might be easier this time after the regulations.

Current Tax Policy For Cryptocurrencies in India

It’s still not clear whether the government will reduce the heavy 30% tax on crypto profits and the 1% TDS (Tax Deducted at Source) on every transaction. These two policies, introduced in 2022, have made crypto trading in India far less attractive. The 30% tax is applied to all gains, with no option to offset losses, unlike in traditional stock trading. On top of that, the 1% TDS is deducted on every trade, even if it’s a loss-making one, which affects liquidity and discourages active trading.

Current Rumours: New Tax Rules That We Can Expect

Industry groups are pushing for a much lower TDS, around 0.1%, to keep trades onshore while preserving government tracking. Though talked about, there’s no concrete news yet on reducing the 30% flat rate.

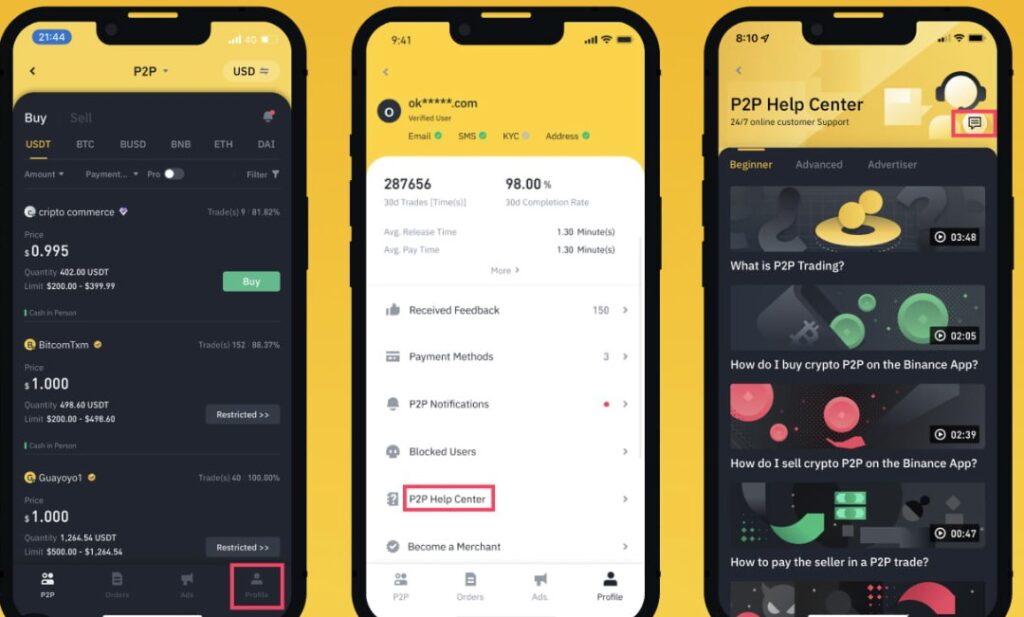

Relief for P2P Traders? What Rumours Say

- No credible rumours suggest the June policy will remove or significantly reduce the 1% TDS for P2P trades.

- The push from exchanges like CoinDCX and CoinSwitch is to reduce TDS from 1% to 0.01% and raise the threshold to ₹500,000 — but this mainly targets on-exchange trades, not foreign P2P deals.

- Binance has already closed down cash-based P2P trading to increase compliance and reduce tax evasion.

- Indian platforms like CoinDCX automatically deduct the 1% TDS, easing compliance for users.

- Guidance from CoinDCX and others currently suggests using regulated Indian exchanges, doing proper KYC, letting the platform handle TDS, and storing records to avoid large penalties and hassles.

India’s Crypto Developments Timeline (2013–2025)

1. 2013 – First Crypto Warning

- Dec 2013: The RBI issues its first public warning about the risks of cryptocurrencies like Bitcoin.

2. 2017 – RBI Flags Crypto Again

- Dec 2017: RBI reissues cautionary notice amid the global crypto boom. The government forms an inter-ministerial committee to study regulation.

3. 2018 – RBI Banking Ban

- April 6, 2018: The RBI issues a circular barring all regulated entities (banks, NBFCs) from dealing with crypto businesses.

- Exchanges lose access to banking services, severely impacting trading volumes.

4. 2019 – Draft Crypto Ban Bill

- July 2019: Draft bill titled “Banning of Cryptocurrency and Regulation of Official Digital Currency Bill, 2019” proposes a complete ban on crypto with penalties and jail time.

5. 2020 – Supreme Court Victory for Crypto

- March 4, 2020: Supreme Court overturns RBI’s 2018 ban, calling it unconstitutional.

- Crypto trading resumes in India, and platforms begin rebuilding.

6. 2021 – Regulatory Uncertainty Returns

- Feb 2021: The Government lists a new Crypto Bill 2021 for introduction in Parliament, reviving fears of a ban.

- Investors and exchanges lobby for regulation instead of prohibition.

7. 2022 – Crypto Tax Introduced

- Feb 1, 2022: Union Budget announces:

- 30% flat tax on crypto gains (no loss set-off).

- 1% TDS on every trade (effective July 1).

- Crypto gets legal recognition as a “virtual digital asset” (VDA), though not as currency.

8. 2023 – FIU Crackdown Begins

- Dec 2023: Financial Intelligence Unit (FIU) issues compliance notices to major foreign exchanges (Binance, KuCoin, Huobi) for operating in India without registration.

9. 2024 – Exchanges Registered, Penalties Tighten

- Jan–April 2024:

- CoinDCX, CoinSwitch, and WazirX begin FIU registration.

- CBDT launches probes into crypto tax evasion.

- 60% penalty tax applied on unreported crypto gains under the new compliance drive.

10. 2025 – Crypto Policy Expected in June

- June 2025 (expected): The Government may release a draft policy paper for public consultation.

- Possible focus areas:

- Crypto classification

- VASP licensing

- KYC/AML rules

- Tax reform

What are your thoughts? Will these new rules change the whole Indian crypto trading?

Comment down your views on this, also make sure to read and follow us for more crypto and finance-related updates.

1 thought on “India to Release Its Crypto Rules in June 2025: India Embraces Crypto A Bold Step Forward for Digital Assets”