Vijay Mallya Podcast Introduction: A Tycoon’s Tale of Truth or Spin?

Once dubbed the “King of Good Times,” Vijay Mallya’s fall from grace is a saga of luxury, loans, and legal battles. In a gripping four-hour podcast with Raj Shamani in June 2025, Mallya breaks his nine-year silence, claiming banks recovered ₹14,000 crore, far exceeding the ₹6,203 crore Kingfisher Airlines debt. But is this a genuine plea for justice or a calculated PR move? This blog dives into Mallya’s claims, from the Vijay Mallya loan recovery proof to unpaid salaries truth, offering fresh insights into a controversy that’s more than just headlines. Let’s unpack the fugitive vs thief narrative with a critical lens.

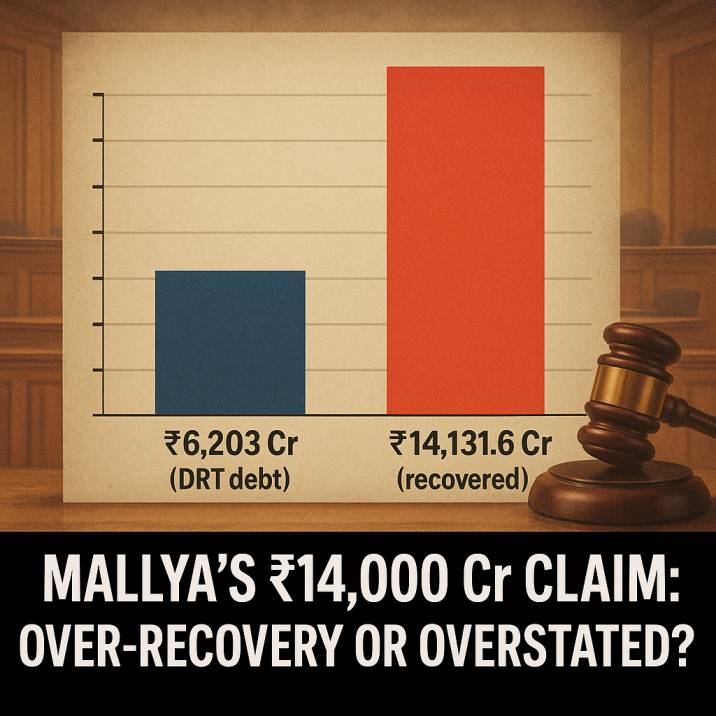

The ₹14,000 Cr Claim: Did Banks Over-Recover?

Mallya’s boldest assertion in the podcast is that banks, led by the State Bank of India, recovered ₹14,131.6 crore against a Debt Recovery Tribunal (DRT) judgment of ₹6,203 crore. He cites Finance Minister Nirmala Sitharaman’s Lok Sabha statement and court documents to argue banks have been overpaid, yet recovery proceedings continue. This Vijay Mallya loan recovery proof challenges the narrative of him as a willful defaulter.

- Court Evidence: Mallya’s petition to the Karnataka High Court in February 2025 demanded a detailed account of recovered assets, including those from United Breweries Holdings (UBHL). He claims banks seized properties and shares far exceeding the original debt.

- Finance Ministry Confirmation: Sitharaman’s statement aligns with Mallya’s claim, noting ₹14,131.6 crore restored to banks, raising questions about why he’s still pursued.

- Counterpoint: Critics argue the recovered amount includes interest and penalties, not just principal, and Mallya’s diversion of funds to personal assets like a ₹330 crore UK and France property purchase muddies his defense.

This discrepancy fuels the public narrative vs court facts debate. Why haven’t banks clarified the excess recovery? Is Mallya’s Mallya DRT documents claim a checkmate or a distraction?

Vijay Mallya Podcast: Unpaid Salaries, Banks Blocked Payments, Mallya Says

One of Mallya’s most emotional moments in the podcast was his apology to Kingfisher Airlines’ employees, unpaid for 15 months by 2013. He claims he petitioned the Karnataka High Court to release ₹260 crore to settle Kingfisher Airlines’ unpaid salaries, but banks and courts rejected it.

- Court Filings: Mallya alleges he offered to pay employee dues, but banks prioritized their own recoveries. Documents from the DRT show his plea was dismissed, raising questions about judicial priorities.

- Employee Impact: By 2013, Kingfisher owed ₹3,000 crore to 3,000 employees, a human cost often overshadowed by loan default headlines.

- Public Reaction: Social media, including posts on X, shows mixed sentiment, some sympathize with employees, others see Mallya’s apology as a PR stunt.

This bank’s objections employee dues claim highlights a systemic issue: when corporate failures hit, why do employees bear the brunt? Mallya’s narrative shifts blame to banks, but does it hold up?

Fugitive or Framed? Mallya’s Defense Against the ‘Chor’ Label

Mallya passionately rejects the Vijay Mallya thief or fugitive tag, arguing he’s a businessman who failed, not a criminal. He insists his 2016 departure to the UK was a pre-scheduled trip, not an escape, and he’s willing to return for a “fair trial.”

- Legal Charges: The CBI and ED accuse Mallya of fraud, money laundering, and diverting ₹9,000 crore in loans to personal ventures like Force India and Royal Challengers Bangalore.

- Mallya’s Counter: He argues criminal fraud vs business failure is misunderstood. The 2008 Lehman Brothers crash, high fuel costs, and government policies crippled Kingfisher, not deliberate fraud.

- Personal Guarantees: Mallya questions, “Does any thief give a personal guarantee?” He claims his personal assets, including ₹3,000 crore infused into Kingfisher, were at stake, a point echoed by industrialist Kiran Mazumdar Shaw.

This Mallya personal guarantee loans argument challenges the corporate vs personal liability narrative. Is Mallya a scapegoat for systemic banking flaws, or is his defense selective?

India’s Business Maze: Mallya’s 29-CM Bureaucracy Jab

Mallya critiques India’s regulatory environment, claiming a 29-CM stack of paperwork was needed for basic business operations. This India business regulatory hurdles point resonates with entrepreneurs frustrated by red tape.

- Government Criticism: Mallya alleges policies, like blocking Etihad’s investment in Kingfisher, accelerated the airline’s collapse. He also claims advice from then-Finance Minister Pranab Mukherjee to downsize came too late.

- Systemic Issues: The Lehman Brothers impact Kingfisher and high aviation fuel taxes in 2008-2012 created a perfect storm. Mallya argues these external factors, not mismanagement, sank Kingfisher.

- Corporate Governance: Critics point to corporate governance failure, citing the SFIO’s findings of financial irregularities in Kingfisher’s merger with Air Deccan.

Mallya’s Mallya government criticism paints him as a victim of India’s business climate, but does it excuse alleged fund diversions?

The ₹3,000 Cr Lifeline: Mallya’s Unseen Investment

Mallya claims he personally infused ₹3,000 crore into Kingfisher via UB Group to keep it afloat, a Mallya personal investment Kingfisher detail often ignored.

- UB Holdings Role: UBHL, as Kingfisher’s guarantor, was meant to cover defaults, but Mallya says his contributions were overlooked in the ignored defense evidence narrative.

- Bank Rejections: He offered four settlement packages between 2012-2015, totaling ₹13,960 crore, but banks rejected them, preferring asset seizures.

- Public Perception: The Mallya bank settlement offers were drowned out by media focus on his lavish lifestyle, like yacht parties and IPL spending.

This Kingfisher loan negotiation truth suggests banks prioritized punishment over resolution. Why were these offers dismissed?

Media’s Role: Villain or Victim?

Mallya accuses the media of a Vijay Mallya media trial, crafting a villain narrative through selective reporting. He claims government press conferences fueled this bias.

- Selective Reporting: Stories of Mallya’s extravagant birthday bashes and Formula 1 spending overshadowed his settlement attempts.

- Corporate Reputation Damage: The selective reporting proof lies in the lack of coverage for his ₹3,000 crore infusion or court petitions for employee payments.

- Social Media Divide: X posts range from calling Mallya a victim of government overreach to labelling his podcast a “whitewash.”

The corporate reputation damage Mallya faced raises questions about media accountability. Is he a convenient scapegoat for a broader banking crisis?

Legal Loopholes and DRT Data

Mallya’s Debt Recovery Tribunal evidence includes DRT documents showing banks recovered ₹10,200 crore by 2017, with an official liquidator confirming full recovery. Yet, he remains a fugitive economic offender.

- Legal Loopholes: Mallya argues legal loopholes explained in corporate guarantees don’t equate to personal theft. His UK bankruptcy appeal, rejected in 2025, cited recovered assets as sufficient.

- Public vs. Court Facts: The public narrative vs court facts gap is stark—media portrays Mallya as a thief, while DRT data suggests over-recovery.

- Extradition Battle: Mallya’s claim of unfair detention conditions in India, violating ECHR Article 3, complicates his extradition.

This Mallya DRT documents focus challenges the public narrative vs court facts divide. Are courts and media aligned against him?

Conclusion: Fugitive, Thief, or Misunderstood Tycoon?

Vijay Mallya’s 2025 podcast with Raj Shamani is a bold attempt to rewrite his story. From ₹14,000 Cr recovery to blocked salaries exposed, his claims force us to question the fugitive vs thief narrative. While evidence like DRT documents and settlement offers supports his case, allegations of fund diversion and lavish spending muddy the waters. The Lehman Brothers impact and India business regulatory hurdles highlight systemic issues, but Mallya’s Mallya personal guarantee loans don’t fully absolve him.

What’s clear is the Vijay Mallya media trial has shaped public perception, often ignoring Mallya court evidence. As he fights extradition, the truth lies in the gray area between corporate failure and criminal intent. What do you think—is Mallya a victim of circumstance or a master of deflection? Share your thoughts below, and check out our other posts on India’s biggest corporate scandals or aviation industry challenges.

Don’t miss our exclusive posts on Exclusive updates. Subscribe for weekly insights and join the conversation!

Sources

https://www.hindustantimes.com/india-news/vijay-mallya-asked-if-he-would-return-to-india-on-podcast-his-fair-trial-reply-101719365478095.htmlhttps://news.abplive.com/business/i-didn-t-run-away-vijay-mallya-breaks-silence-in-viral-podcast-check-here-1690437https://www.hindustantimes.com/trending/indian-billionaire-publicly-backs-vijay-mallya-why-is-he-still-a-political-punching-bag-101719365478095.htmlhttps://www.statemirror.com/news/vijay-mallya-raj-shamani-podcast-claims-rs-14100-crore-recovered-more-than-alleged-loan-defaulthttps://indianexpress.com/article/business/vijay-mallya-podcast-it-was-always-my-intention-to-settle-vijay-mallya-on-kingfisher-airlines-case-9168737/https://www.telegraphindia.com/india/vijay-mallya-podcast-from-chor-to-always-grateful-vijay-mallyas-podcast-triggers-one-outburst-after-another/cid/2026723https://www.moneycontrol.com/news/trends/i-didnt-run-away-vijay-mallya-reveals-on-raj-shamanis-podcast-fans-ask-him-to-have-faith-in-god-11961501.htmlhttps://www.news18.com/viral/fugitive-vijay-mallyas-return-explained-through-these-viral-instagram-reels-8513920.htmlhttps://www.theweekendleader.com/Headlines/66426/on-figuring-out-with-raj-shamani-vijay-mallya-tells-his-side-of-the-kingfisher-story.htmlhttps://www.livemint.com/news/trends/god-is-watching-you-vijay-mallya-netizens-react-as-podcast-with-raj-shamani-hits-2-8-million-views-1169365478095.htmlhttps://www.reddit.com/r/india/comments/1d95i7k/i_worked_at_vijay_mallyas_former_legal_firm_in_a/https://thefederal.com/opinion/mallya-podcast-is-he-plotting-india-return-or-just-pr-noise-after-rcb-win/https://thefederal.com/opinion/mallya-interview-a-fact-check-his-version-of-truth-and-what-he-leaves-out/https://www.newindianexpress.com/business/2025/jun/06/my-intentions-were-always-to-repay-the-loans-vijay-mallyahttps://www.hindustantimes.com/india-news/call-me-a-fugitive-but-i-am-not-a-chor-vijay-mallya-addresses-charges-against-him-101719365478095.htmlhttps://www.hindustantimes.com/india-news/whats-the-actual-loan-taken-by-vijay-mallya-former-businessman-answers-101719365478095.htmlhttps://www.livemint.com/news/india/vijay-mallyas-big-claim-on-cbi-lookout-circular-against-him-i-went-in-and-out-multiple-times-and-never-had-a-problem-1169365478095.htmlhttps://www.oneindia.com/india/vijay-mallya-podcast-king-of-good-times-ready-to-return-to-india-if-assured-fair-trial-9168737.html